Why Green Ammonia ?

Page as of 27/09/24 copied before major edit

There are important reasons why coal, oil and gas took over from wood, wind and water as the principal energy sources powering the global economy - those fossil fuels were plentiful, energy-dense, easily stored and transported, and constantly available on demand. Now, as the world transitions to a zero-carbon energy system, we need a renewable, carbon-free fuel that has those same qualities. It has to be able to move cheap renewable energy from places with abundant sunshine and wind, to where it’s needed, when it’s needed. That fuel is Green Ammonia.

When Renewable Energy Powered the World

Before the industrial revolution, almost all the energy available to people was renewable. The world was fuelled and powered by wind, water, wood, charcoal, and food grown for oxen, horses, and of course, people.

But that all changed with the invention of the steam engine and the use of coal as an energy-dense, on-demand energy source, powering boilers, mills, coal mine pumps, trains and diverse industries; later to be joined by its fellow fossil fuels, oil and natural gas.

Photo: Windmills at Kinderdijk, Netherlands. Credit: Willard84, CC-BY 3.0 via Wikimedia Commons.

Using only renewable energy sources, the development of industry was constrained in two ways.

Not enough energy was available. Windmills, water wheels, forests and farms could only generate a limited amount of energy, insufficient for the needs of a growing industrial economy.

Energy was not consistently available when needed. To grind grain in a windmill, you had to wait for a windy day. To drive a cotton mill using hydropower, the river had to be flowing.

Energy could not be transported, other than wood (heavy) and charcoal (expensive). Industries had to be rooted where the wind blew, or water ran.

With the arrival of coal boilers and steam engines, factories, mills and mines were liberated from these constraints, of quantity, time and place, and business boomed. These ‘fossil fuels’, geologically transformed biological residues deposited many millions of years ago, have now been heating and powering our homes, workplaces and transport for almost 300 years.

Photo: The arrival of coal as an industrial fuel changed everything! Credit: Public Domain.

We still need energy-dense, on-demand fuels

Now have to stop burning fossil fuels with all possible speed to prevent catastrophic climate change. This will be mainly be achieved by electrification, because most renewable energy - solar PV, wind and hydroelectric - is produced as electricity, and is most efficiently used in that form. Thus electric cars are taking over global markets, steel is made using electric furnaces, and homes and businesses will increasingly be warmed by electric heat pumps.

But the need for energy-dense, on-demand fuels won’t go away, even in our future zero carbon world. We have solved the problem of producing the required quantities of renewable energy, given the development of cheap and efficient solar PV and wind turbines, not to mention hydropower. Even a small and densely populated country like the UK is now capable of satisfying its entire energy (not just electricity) demand from renewables twice over.

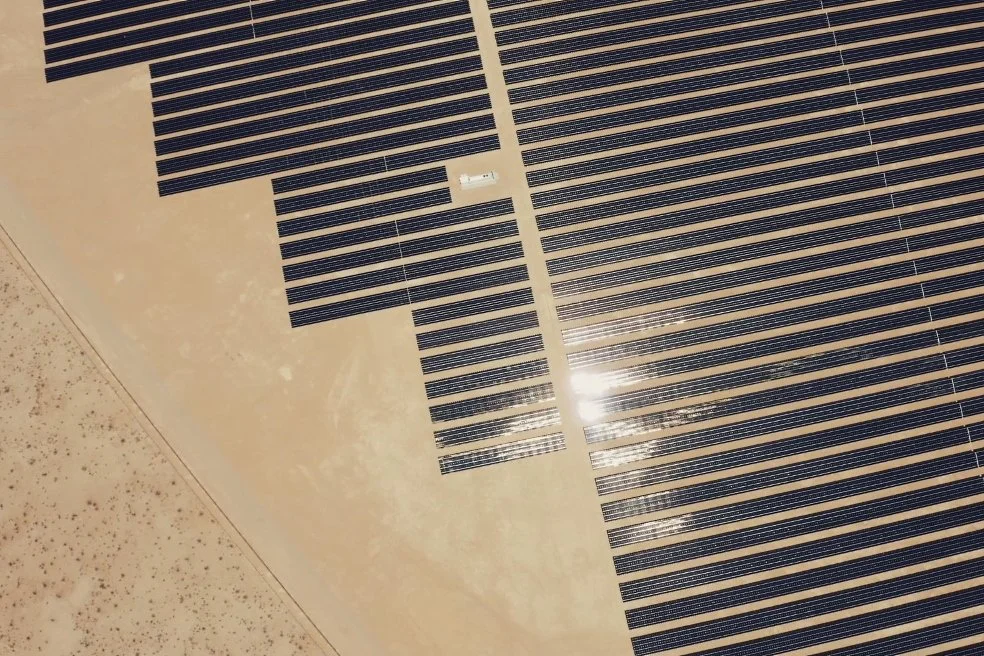

And renewable energy costs are low. In the UK onshore wind is the cheapest of all ways of generating electricity. In 2021 Saudi Arabia built a 600MW solar PV project at a power price of just over one US cent ($0.0104) per kWh. Of course prices go up and down with inflation, interest rates and wider financing costs, but the price trajectory is firmly downwards for the foreseeable future.

For example, Oxford PV recently announced that its latest solar modules, based on low-cost perovskites, are 26.9% efficient - up from a typical 21% today. When these come to market they’ll increase the output of solar installations on a given area by a massive 28%.

Photo: PV Power Generation at Jericho, Palestine. Credit: TrickyH / Wikimedia Commons, CC-BY 4.0.

Photo: Offshore wind turbines off Block Island, R.I. Credit: Dennis Schroeder / National Renewable Energy Lab, CC BY-NC-ND 2.0

Photo: Vanadium flow batteries are well suited to support power grids, but too costly for long-term storage. Image: TNG Energy.

However we still have the problem faced by 18th century industrialists, of how to match power generation to demand, when our wind and solar generators are variable in their production. The answer must be, to store up renewable power when it’s abundant, and release it when needed over periods of:

hours to days, to ensure grid stability, and meet spikes in power demand.

days to weeks, to tide countries over weeks of ‘Dunkelflaute’ - the German term for prolonged periods of still, cloudy weather that bring much renewable power generation to a standstill.

months and years, to provide inter-seasonal energy storage and create a long term energy buffer to guard against unusual but certain to occur events like volcanic eruptions capable of reducing solar generation.

To decarbonise the global economy, we also need to use renewables to make fuels for transport and industry. Batteries are great for short term energy storage: in domestic vehicles, for example, and to balance fluctuating supply and demand on the grid. Flow batteries will be particularly well suited to the last of these purposes. But they’re too heavy for long distance shipping and aviation, and far too expensive to keep entire countries supplied with electricity for weeks or months.

As the UK Energy Research Council (UKERC 2021) puts it, “Even with the enormous improvements in battery technology they still fall several orders of magnitude short in both available power and its duration when compared to chemical storage, such as currently embodied in fossil fuels. Even if this could be overcome, replacing just a day’s worth of natural gas balancing capability with batteries would cost over £1 trillion.”

We also needed to be able to move that energy from where it can be produced cheaply, to where it’s needed.

Green Hydrogen?

So what choice of fuels do we have? Well, hydrogen is easily generated from electricity by electrolysis (using electricity to split water into hydrogen and oxygen). And it can be used as a fuel, for example to generate electricity with high (60%+) efficiency in fuel cells. It clearly has its place.

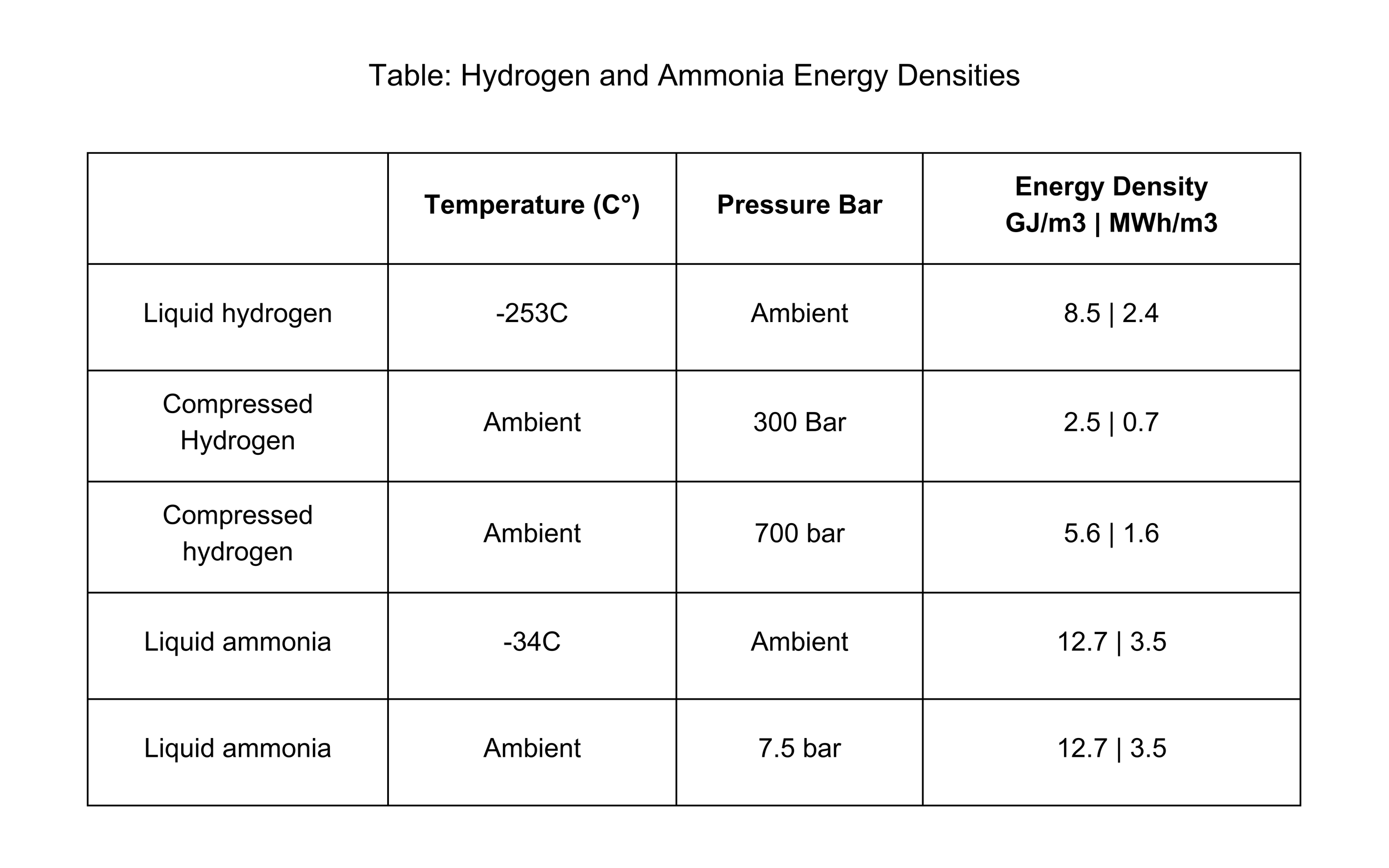

Hydrogen is hard to store or transport owing to its extreme volatility. To liquefy it at ambient pressure it needs to be cooled to -253C, and even then only has a density of 71 kg/m3. Alternatively it can be compressed, usually to either 350 or 700 bar (atmospheres) to make a liquid-like supercritical gas with a density of 26 kg/m3 or 42 kg/m3, respectively.

Whether cooled or compressed, preparing hydrogen for storage takes energy: 10 MWh/t for cryogenic liquefaction, 3 MWh/t for 700 bar pressure, or 2 MWh/t for 350 bar pressure.

Note that the liquefaction cost is predicted to fall to 7 MWh/t based on active magnetic regenerative liquefiers, and that this novel technology is “potentially capable of lower costs than conventional liquefaction plants especially at small liquefaction scales (2,000 to 5,000 kg of liquid hydrogen per day).”

But that won’t be a game changer. The energy costs of hydrogen liquefaction or compression are actually tolerable provided the operation takes place at the production end where energy (in most cases solar) is super-cheap, given hydrogen’s very high energy value of 120 GJ (33.3 MWh) per tonne.

The biggest problem for hydrogen as a long term energy storage medium (eg, for interseasonal power generation) is the high cost of containing it in either high pressure or low temperature tanks.

According to Andrew Burke and colleagues of the Institute of Transportation Studies, UC Davis (2024) the cost of a 1,500 kg tank operating at 350 bar is $650-$700 /kg, or about $20 /kWh. This puts it in the same cost bracket as lithium batteries - but with much lower round trip efficiency (less than half the typical 80% of batteries).

Super-insulated tanks for liquid hydrogen are much less expensive at about $70-$105 /kg, according to Burke, or just $2-3 /kWh. But other costs are greater, including the initial cooling to -253C and the ongoing boil-off of hydrogen caused by thermal leakage. This latter cost is minimal in a very large tank, but significant in small tanks, rendering them unsuitable for passenger vehicles.

The final option is to store hydrogen in large underground salt caverns, constructed in deep, geologically stable halite structures such as salt domes. This option is examined in detail on our Alternatives to Green Ammonia page, which shows that UK’s geology offers a huge potential salt cavern resource for grid balancing far greater than our needs.

And costs are modest, equating to $0.036 (£0.03) /kWh on a 120 day cycle, and $0.005 (£0.004) on a 15 day cycle. Salt caverns should be used preferentially for hydrogen storage wherever geographically available, “especially long-term storage as no other option offers such a high cost-effectiveness”, Burke concludes.

But where’s all that hydrogen going to come from? Hydrogen is expensive, bulky and inconvenient to move: there are no bulk carrier ships to transport it in; and there’s little to no infrastructure to handle it at ports. So much of any hydrogen used for energy storage be locally generated, produced from power surplus to immediate needs arising from abundant wind and solar.

And if that’s not enough for us, we can import it in the form of Green ammonia, which may be used unaltered, or split into hydrogen and nitrogen. That ammonia can also be stored in salt caverns (provided they are lined to prevent salt dissolution), and at lower cost (per unit of energy) than hydrogen: a cavern full of liquid ammonia at 10 bar contains nine times as much energy as one full of hydrogen at 150 bar.

Image: Liquid Hydrogen Tank at NASA's Kennedy Space Center. Hydrogen is very expensive to store at a viable energy density: either as a super-cooled liquid below -253C, or at a pressure of 350-700 atmospheres. Credit: US Department of Energy / Public Domain.

Photo: a 93 litre insulated tank for liquid hydrogen, located at the Deutsches Museum in Munich. It requires a vacuum between the inner and outer containment layers. Credit: Tiia Monto via Wikimedia Commons, CC BY-SA 3.0.

Image: crystals of high purity mineral halite from the Wieliczka salt mine in Poland - the ‘evaporite’ residue of an ancient salty sea. Halite deposits can be hundreds of metres deep and extend over many thousands of square kilometres. Such deposits will be of increasing value for storing Green hydrogen and ammonia produced from renewable energy. Credit: Lech Darski via Wikimedia, CC BY-SA 4.0.

Hydrogen - Conclusion

Green hydrogen has important but limited role to play. If countries with appropriate geology, and good potential for low-cost renewable power generation, it makes sense to build renewable generators that can supply power well beyond the need for immediate consumption, and use the surplus to generate hydrogen for storage in salt caverns. But if additional energy needs to be imported to meet backup needs, that would better be in the form of Green ammonia.

In countries without capacity for salt cavern construction, hydrogen is problematic for long term storage owing to the high capital cost of storage tanks or excavated hard rock caverns. Containers suitable for hydrogen are also heavy and / or bulky so making hydrogen fuel suboptimal for aviation.

Further, special purpose infrastructure (tankers and port handling facilities) is required for the shipping of liquid hydrogen at -253C, the preferred option owing to its greater intrinsic safety, low volume compared to compressed gas, and the much lower containment cost. However little to none of this infrastructure exists at present.

Image: Schematic diagram of the Green methanol economy. Credit: MDPI / Department of Energy Technology, Aalborg University.

Green methanol ?

It is also proposed that we should use renewable energy to produce carbon-based synthetic fuels like methane, or methanol, taking the necessary carbon from CO2 rich gas streams like gas power station fumes, or by atmospheric extraction. The chemical processes are well understood and this offers a relatively rapid route away from fossil fuels, because these synthetic carbon fuels are very similar to them.

But these represent only a temporary solution. With the necessary declines in fossil fuel combustion, rich sources of CO2 will become scarce leaving air capture of CO2 as the very dilute and thus expensive source of last resort. The technology will undoubtedly have its uses to replace fossil carbon in chemicals, oils, lubricants, etc, based on continuing CO2 emissions from kilning cement, fermentations, and so on, but not for large scale energy applications.

Image: Green ammonia produced using renewable energy can be used for power generation, energy storage and transport, fuel and fertiliser. Source: The Davos Agenda / World Economic Forum, CC BY-NC-ND.

Photo: Electrolysers like this Siemens model are crucial for our Green energy future, as they convert renewable electricity into hydrogen and oxygen. The hydrogen may then be combined with nitrogen to produce ammonia. Credit: Siemens.

Photo: the world’s first purpose-built liquefied hydrogen carrier, the Kawasaki Heavy Industries Suiso Frontier, at port in Kobe, Japan. Credit: Hunini via Wikimedia Commons, CC BY-SA 4.0.

Or Green Ammonia?

The remaining choice is ammonia - the active ingredient of the smelling salts favoured by heroines of 19th century romantic fiction. It’s also the feedstock for making nitrate fertiliser (almost all currently made using fossil fuels), and an important refrigerant for industrial freezers.

Ammonia as a fuel may be seen as a hydrogen carrier. Each molecule of ammonia contains one atom of nitrogen and three of hydrogen. So a given volume of ammonia gas (NH3) contains 50% more hydrogen than hydrogen gas (H2). Moreover ammonia can be liquefied, at ambient pressure, at a temperature of just -33.3C. Incidentally this liquid ammonia contains about 65% more hydrogen than liquid hydrogen at -253C.

There is an energy cost of turning hydrogen into ammonia, representing the energy of extracting nitrogen from air, compressing and heating the gas mix, and subsequently cooling the resulting mixture of gases to extract the ammonia as a liquid.

These energy costs are set out in detail in our page on Green ammonia production, and amount to about 0.95 MWh / tonne of Green ammonia, or 17/3 x .95 = 5.4 MWh / tonne of hydrogen. That’s just over half the energy cost of cryogenic hydrogen liquefaction.

The energy cost of converting hydrogen to ammonia is affordable, especially when carried out ‘upstream’ where power prices are low, and results in a product that is much more readily stored and transported, and at considerably lower cost.

To summarise, Green ammonia’s main advantages as a fuel over Green hydrogen are:

It’s significantly richer in energy per unit of volume at moderate temperatures and pressures. See table below.

Its storage and transportation is easier, cheaper and safer, with lower ‘boil off’ losses, as it does not require the extremes of low temperature / high pressure associated with hydrogen. This also results in much lower weight of containment, a very important factor in, for example, aviation.

Its use avoids the need for the significant advance investment in specialist marine bulk gas carriers, storage and port handling facilities that hydrogen would require before its global trade could even commence.

By contrast ammonia is compatible with the ships and port facilities used for existing classes of industrial gas cargo that are already shipped around the world in huge volumes including LPG, LNG, PVC monomer - and ammonia itself.

Multipurpose Fuel of the Future

We believe that Green ammonia - ammonia made from air, water and renewable electricity - is the energy-dense, on-demand fuel that can replace fossil fuels. It has an energy density about half that of equivalent fossil fuels like LNG and LPG - which is plenty to do the job demanded of it. It can also be cheaply transported around the world in existing bulk carriers (for LNG or LPG for example) with little or no modification.

Uses of Green Ammonia will include:

making fertiliser, explosives and other products (as it long been doing, with the result that there already exists substantial ammonia infrastructure and knowhow);

generating grid scale electricity (by combustion in adapted gas fired power stations, or with higher efficiency in fuel cells);

powering ships, aircraft, trains and other large scale transport, and maybe smaller scale transport too;

serving as an industrial fuel for a wide range of purposes, from steel making to cement kilning and firing ceramics.

Another feature of Green ammonia is that it can be burnt in solid oxide fuel cells with far greater efficiency (60-70%) than conventional combustion engines. However this approach is not yet market ready. The main drawback is that the ceramic fuel cells are fragile and unable to withstand substantial shock or vibration, and operate best in continuous operation.

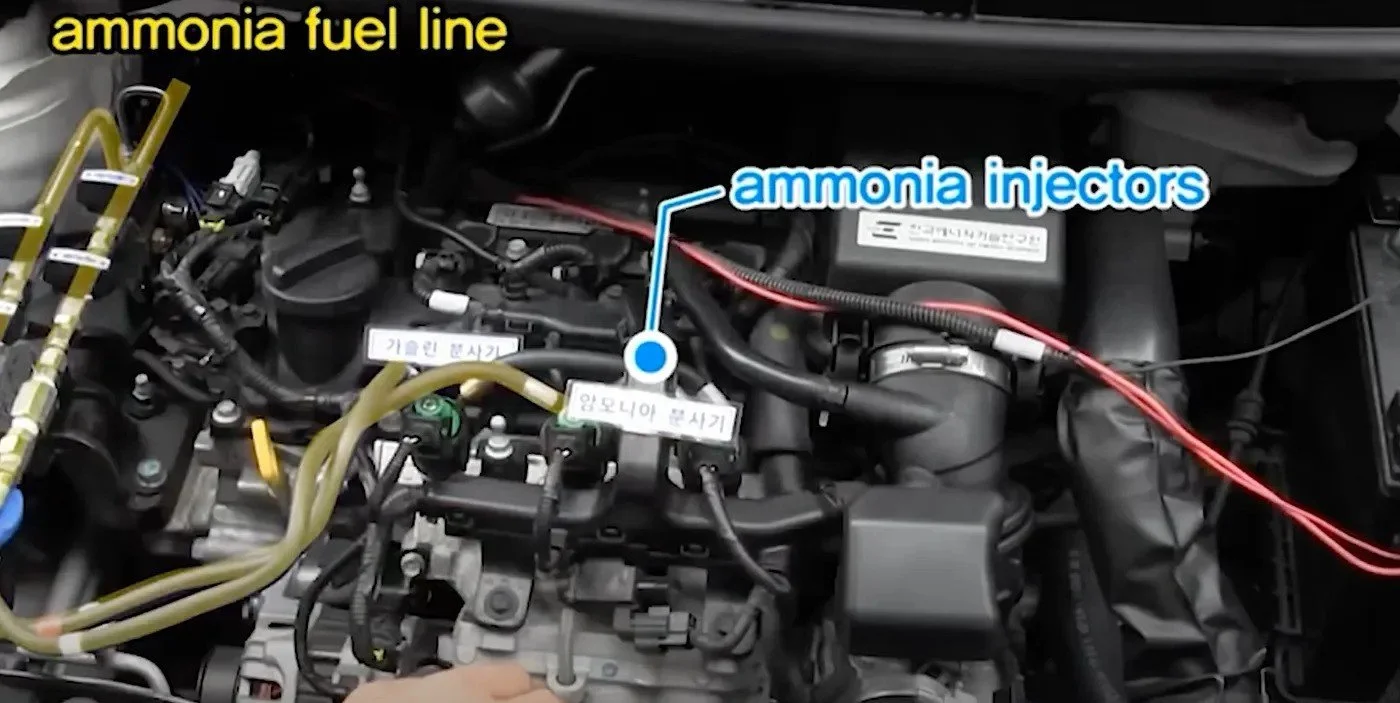

Ammonia may also be burnt in conventional internal combustion engines, indeed the carmakers Toyota and China’s GAC have invested significantly in developing an ammonia compatible engine. The problem of ammonia’s high ignition temperature and low flame speed may be overcome by cracking 10-20% of the gas to hydrogen and nitrogen, and recombining the three gases before ignition

We expect that Green ammonia will be produced in two main modes:

Large scale production in sunny parts of the world with lowest cost renewable energy, with access to water, and transshipment facilities close to shipping routes. Multi-gigawatt solar PV projects aimed at large scale ammonia production and its export in bulk gas freighters to international markets are already under construction in South Africa, Australia and other countries.

Also important will be generation in temperate latitudes where grids are mainly powered by wind, solar and hydro. Power generated in excess of immediate electrical demand will be used to build up energy stores, whether as hot water in millions of immersion tanks; by filling up pumped storage water reservoirs; or as Green hydrogen / or Green ammonia that can be used for grid backup, or as industrial or transport fuels.

Illustrating the second point above, Norway is actively developing its Green ammonia production capacity, for example in the recently announced partnership between hydro generator Statkraft and Fortescue at Holmaneset.

Powered by about 300 MW of hydro electricity, the project will produce over 40,000 tonnes of renewable hydrogen / 225,000 tonnes of renewable ammonia per year. The plant will run on surplus renewable electricity generated locally and in neighbouring countries, reinforcing Norway’s growing roles as Green hydrogen / ammonia producer and exporter, and grid-balancer for northern Europe.

Image: principles of an Atrex SOFC fuel cell, capable of burning ammonia. The tubular design prevents catastrophic damage from temperature gradients that occur during thermal cycling. Credit: Atrex Energy.

Image: schematic diagram of how pure ammonia fuel may be partially cracked into hydrogen and nitrogen (typically 10-20%) then mixed back with ammonia, before being injected into an ordinary internal combustion engine. The cracker runs off the engine’s waste heat. Credit: Sunborne Systems.

Photo: Toyota’s ammonia-fuelled engine, which Toyota CEO Akio Toyoda describes as “the end of EVs”. Credit: Toyota via Pareto Investor.

Photo: The Holmaneset Energy Project in western Norway will convert surplus locally generated renewable power into Green hydrogen and Green ammonia.

Photo: Onshore wind is the UK’s cheapest power source, however almost all new onshore wind farms are in Scotland and Wales due to England’s discriminatory planning policies. Credit: Black Hill Wind Farm in the Scottish Borders by Walter Baxter via Geograph CC-BY-SA 2.0.

Photo: These perovskite-based PV cells, developed by Oxford PV and the Fraunhofer Institute for Solar Energy Systems, can convert 25% of incident solar radiation energy into electricity, establishing a new world record in January 2024. Credit: Fraunhofer Institute.

Photo: UK power prices are set by the cost of gas fired generation at plants like this 2.2GW CCGT (combined-cycle gas turbine) in Pembrokeshire, Wales. High gas costs mean electricity bills are at near record levels. Credit: RWE.

Is the Green Economy Affordable ?

The transition away from fossil fuels is often presented - and especially by those opposing action against global heating - as a hugely costly undertaking that will make life much more expensive. However this narrative is weakened by recent huge increases in fossil energy prices which have left renewable electricity much cheaper than power generated from gas.

As a result, in the UK, renewables no longer need subsidy, but only medium term price guarantees, for example in the offshore wind sector, at levels lower than prevailing wholesale power costs. In the case of onshore wind, the UK’s lowest cost generation technology, turbine construction in England is prevented by restrictive and discriminatory planning regulations, while the sector is developing rapidly in Scotland and Wales.

Field-scale solar power developers are faring better, without subsidy, raising investment purely on the basis of power purchase agreements with energy users, and reliance on future power markets. See for example the Botley West planned 840 MW solar development near Oxford.

Looking globally we have seen solar power prices in optimal locations in the Middle East drop as low as $10 /MWh. Prices were pushed up by rising interest rates and supply chain inflation in 2023 to about three times that level, but have now fallen to around $20 /MWh. Technology improvements in the pipeline, for example perovskite panels, suggest a future of continuing power prices declines.

So it’s not renewable energy that has been pushing up energy prices. On the contrary. In countries like the UK it’s the failure to build enough renewable generation, forcing us into continued reliance on expensive fossil fuels, in particular natural gas. The future world we face is actually one of electricity cheap beyond precedent - at least while the sun is shining, or the wind is blowing.

But for renewables to fully displace fossil fuels, we need to go further. We need a complete on-demand renewable energy system that’s not just cheaper, but also at least as secure and flexible as the fossil fuelled system it’s replacing. That system will have to provide electricity at all times, even when it’s dark and cloudy. And it will have to deliver the fuels needed by industry, ships, aircraft and other vehicles.

The foundation of the low cost element will be the ever declining price of renewable energy and the continuing large scale build out of renewable power generation of the kind most suitable to each location. That will provide an abundance of renewable electricity to keep grid power prices low for most of the time.

Security of Supply: Infrastructure

The difficulty arises when power generation is short yet electrical demand is high. This is when power prices are liable to increase sharply, often to many times their normal level. At one point in winter 2023 UK spot power prices reached £3,000 / MWh, about 50 times the generally prevailing price of around £60 / MWh.

Short periods of excess power demand over generation can be kept short through a combination of measures such as pumped storage reservoirs (Dinorwig being a well known example), grid scale batteries, thermal storage both domestic and industrial, the use of short term reserves of locally generated Green hydrogen, load shifting on electric car chargers and domestic appliances such as washing machines and freezers; and continental scale interconnectors to balance supply and demand fluctuations over a wide geographical area.

The difficulty arises in those periods of prolonged cold, cloudy, still high pressure weather now generally known by the German term Dunkelflaute. Britain suffered the longest recorded such event in March 2022, lasting for eleven continuous days of very low wind and solar generation, almost all replaced by gas generation placing extreme strain on both gas supplies and generation capacity. More typically periods of 50-100 hours of Dunkelflaute are experienced in North Sea and Baltic countries each of November, December and January.

The 2022 UK Parliament report on Longer Duration Energy Storage advises that in order to end the role of natural gas in grid balancing, the following scale of energy storage is required: 3-4 TWh for inter-day applications; 10s of TWh for seasonal applications; and ~100 TWh for multi-year applications. It further notes that “Substantial electrification of the heat sector would also transfer much of the heat demand, currently met largely by natural gas, onto the electricity system. This may create the need for even more electricity storage capacity.”

Let’s take the above-mentioned 100 TWh of energy storage as a guarantor of security of electrical supply through multiple Dunkelflaute events in a UK fully powered from renewable sources, including allowance for the additional future use of electricity for heating and vehicles. Ammonia has an energy value of 5.2 MWh / tonne so to store all the required energy as Green ammonia would require some 20 million tonnes of storage capacity, hence 30 million m3. The gas could be burnt in existing gas turbine generators following adaptation.

Based on a typical large bulk gas carrier size of 150,000 m3, 200 such carriers full would be required. The world’s largest cold liquid ammonia tank, owned by Norway’s Yara, holds 60,000 m3. 500 such tanks costing some $25 million each (say £20 million) would hold the UK’s entire ammonia reserve requirement for grid support for a year with unfavourable conditions for renewable power generation.

Alternatively salt caverns would also offer suitable storage for pressurised Green ammonia (see our analysis of salt caverns for hydrogen / ammonia storage on the Alternatives to Green Ammonia page). Burke (2024) reports that a 50,000 m3 salt cavern has a construction cost of $18m. So we’re looking at a very similar construction cost for pressurised salt cavern storage, as for cold storage in insulated above ground tanks.

The capital cost of the storage would therefore be about £10 billion. Other Green ammonia infrastructure costs, such as laying down ammonia pipelines, constructing ammonia bunkering facilities at ports of importation, adapting existing gas fired power stations to ammonia combustion, could well double that sum.

But for a core element of the UK’s green energy transition the sum is actually surprisingly affordable. To put it in perspective, it’s about half the cost of the Hinkley C nuclear power station, now estimated by EDF at some £46 billion, and under a third of the cost of the UK’s HS2 railway between London and Birmingham, now projected to cost taxpayers £66 billion.

And in fact, ammonia storage on that scale may not be necessary. ‘Storage’ need not only mean physical storage on land, but might include a proportion of ammonia in tankers on their way to the UK, or contracted for future delivery, or that could be purchased on the high seas for delivery to the UK - much as currently takes place with oil and gas.

Photo: The challenge is to meet all energy needs from renewables, all the time! Credit: London skyline by Dronepicr via Wikimedia CC BY 3.0.

Photo: in an all-renewable energy system, power must be available on demand at all times. A ‘Dunkelflaute’ event seen at Great Woodend Farm near Ross-on-Wye. Credit: Roger Davies via Geograph.

Photo: Llyn Paris on the Elidir Fach mountain. The lake is used as the lower reservoir for the Dinorwig pumped-storage power station in North Wales. Credit: Denis Egan CC-BY 2.0 via Flickr.

Photo: A 36,200 m3 cryogenic tank for liquid ammonia under construction by Geldof. The tank has a concrete outer shell, a carbon steel liner, and high performance insulation in between. Credit: Geldof.

Photo: Can Green ammonia compete? With its restoration of the Rough Gas Storage Facility in the North Sea, Centrica doubled the UK’s storage capacity to some 20 TWh, enough for 12 days’ usage. Photo: Centrica.

Photo: The 2GW Al Dhafra solar project in Abu Dhabi is among the world’s biggest, and cheapest. Similar projects will set the international price for Green ammonia. Photo: ESFC.

The Cost of Green Ammonia

As already set out, Green Ammonia (LGA) will be an essential part of that system. But to make serious inroads into the market for fossil fuels, in the absence of regulatory drivers, it should be available at a price that’s close to or under that of the fossil fuel equivalent. It currently takes about 18 MWh of renewable electricity to make a tonne of ammonia (see our page on Green Ammonia Production).

In 2021 the 600MW Al Shuaiba 1 solar power generation project in Saudi Arabia received the lowest ever tender price at $10.4 /MWh (a sliver over one US cent /kWh). That followed the previous record low price in 2020 at the 1.5GW Al Dhaffra project in Abu Dhabi of $13.50 [6].

Prices subsequently rose, due to inflation, and higher interest rates increasing financing costs, reaching a minimum levelised cost of energy (LCOE) around $25 /MWh [8] in mid-2023. But prices have now fallen again, with the winning bid for the latest 1.8 GW phase of the Mohammed bin Rashid Al Maktoum Solar Park in UAE coming in at just $16 /MWh.

On that basis we work from a low cost solar electricity price of $16 x 18 = $288 /tonne of Green ammonia. We know that electricity typically accounts for 90% of Green Ammonia production cost [9] so we get a cost of $320 /tonne. Add $100 /tonne for shipping & bunkering, to get an estimate of a tonne of Liquid Green Ammonia (LGA) from a low cost producing country, delivered to its temperate country destination for $420.

Ammonia combustion yields 5.2 MWh (thermal) / tonne, so we get a price of $81 (£64) /MWh [1].

UK LNG prices over 2024 average about £0.70 / therm, or £24 / MWh. So imported LGA is around 2-3 times as expensive as LNG today, in energy terms. Burning Green ammonia for power at 60% efficiency implies an energy cost of electricity of £107 / MWh = £0.107 / kWh. Let’s round that up to £0.15 to include costs of generation. This cost compares favorably with the current ‘price cap’ power cost of £0.2236 /kWh.

Our Cheap Green Energy Future

But in the zero carbon world, most national economies will run using low-cost renewable electricity that’s used as it’s produced. They will also be using those renewable generators to charge up batteries and produce Green hydrogen (and / or Green Ammonia) locally, both for grid backup and for sale into other sectors. It’s only when that’s not enough that additional imported LGA will be needed.

Currently UK solar power costs about £0.041 / kWh, onshore wind £0.044 / kWh and offshore wind power about £0.073 / KWh. Ascribing an equal role to each in the UK’s power generation mix we get a cost of £0.053 per kWh. If we assume that this cheap renewable energy provides 80% of our power, and Green ammonia 20%, then the average cost is £0.072 / kWh.

Photo: the Dinorwig pumped-storage hydropower station lies within the Elidir Fach mountain, North Wales, scarred by decades of slate mining. Credit: Denis Egan CC-BY 2.0 via Flickr.

That’s less than a third of the current UK domestic electricity price cap of £0.2236 / kWh. Not to mention the peak wholesale power price of over £2,500 / MWh briefly achieved in December 2022 !

This indicates that a renewable electricity system as set out above, with Green Ammonia used for an average of 20% of the time to supply peak electricity demand and to cover ‘dunkelflaute’ events, would represent an enormous reduction in cost compared to the UK’s current system in which the price is set by expensive natural gas.

Another target for Green Ammonia is shipping, currently fuelled mostly by bunker / marine diesel oil (MDO). We find [4] that at current MDO prices of $660 /tonne, the energy equivalent volume of liquid ammonia, at our estimated $300 /tonne, would cost $582, in other words a saving of over 10%.

Given the likelihood that LGA production will be concentrated in areas on or close to main shipping routes, we can be sure that ships would generally fuel up when passing such production and transshipment centres. Our price estimate for LGA includes a $100 /tonne element for shipping. If that cost is eliminated, we may reprice our LGA at $200 /tonne, and our tonne of bunker oil equivalent cost becomes $382, about 42% cheaper than MDO.

Further, marine engines burning heavy oil operate at a typical thermal efficiency of about 30%. If the LGA is burnt in SOFC fuel cells to generate electricity for propulsion, with an efficiency of 60%, that would again halve the effective cost of the LGA, yielding a fuel cost saving of 58%.

We can conclude that lowest cost Liquid Green Ammonia from optimal locations already is highly price competitive with fossil energy. Further, there are good prospects for Green Ammonia to become even cheaper as a result of technology improvements. These include:

further declines in the cost of renewable energy, solar PV in particular

increases in the efficiency of electrolysis of water to hydrogen and oxygen

greater efficiency in the Haber Bosch process, which produces ammonia from hydrogen and nitrogen

the development of new ‘one step’ electrochemical systems of ammonia production directly from air and water.

So what’s getting in the way of Green Ammonia’s imminent takeover of global energy markets? Really, it’s just time. Huge investments are already being made in solar PV-based Green hydrogen and ammonia production in countries around the tropics and subtropics.

Bulk gas carriers to transport it are in operation, with more on order. New ships are being built that are capable of switching between fuels, including ammonia, and a new regulatory environment for ammonia fuel under the IMO is fast taking shape. Green ammonia-fuelled train locomotives will soon be in operation in Brazil, farmers in the US Midwest are running tractors on home-made ammonia, and battery-powered passenger aircraft and air taxis are taking to the skies, capable of extending their range using ammonia fuel and Solid Oxide Fuel cells.

The world’s biggest fertiliser manufacturers are switching to Green ammonia feedstocks. Manufacturers of gas turbines and industrial burners are developing ammonia-compatible plant, and one ammonia-converted gas turbine power station in County Cork, Ireland is soon to begin operation. Entire energy intensive industries, notably steel, are moving fast towards hydrogen-reduced steel manufacture, 100% compatible with ammonia as a drop-in replacement.

The global Revolution is already under way! But as far as the UK is concerned, there’s little to no indication that this fact has penetrated through to ministers, other senior politicians, or civil servants responsible for energy policy - who remain inexplicably wedded to an over-hyped and under-delivered ‘nuclear renaissance’, and show no sign of giving up on fossil fuels any time soon.

Notes

Ammonia’s thermal energy value is quoted as 18.6 GJ per tonne (or 12.7 GJ / cubic metre for cold ammonia). 3.6 GJ = 1 MWh. So we have 5.2 MWh per tonne of ammonia.

Liquid Petroleum Gas (LPG) is composed of a mix of gases so there is no hard figure for its density but 550kg / cubic metre is a reasonable average figure. LPG has a typical energy density of 46 GJ / tonne, hence 25.3 GJ / cubic metre.

The 2023 UK price of LPG is $946 /m3, equivalent to $1,720 (£1,420) /tonne. A tonne of LPG is equivalent in energy value to 46 / 18.6 = 2.5 tonnes of ammonia, worth (at our estimated $400) $1000. That represents a 42% discount, GJ for GJ, for ammonia versus LPG.

Bunker or marine diesel oil typically costs $700/m3 and has an energy density of 36 GJ/m3. The energy equivalent amount of liquid ammonia would be 1.94 tonnes. At $300 /tonne that ammonia would be worth $582, more than 10% less than the current price of bunker oil.

Round-trip Efficiency of Ammonia as a Renewable Energy Transportation Media https://www.ammoniaenergy.org/articles/round-trip-efficiency-of-ammonia-as-a-renewable-energy-transportation-media/

https://www.pv-magazine.com/2020/07/27/exclusive-interview-jinkopower-on-how-it-offered-the-worlds-lowest-solar-power-price/

https://www.energy.gov/eere/fuelcells/articles/fuel-cells-fact-sheet

https://www.pv-magazine.com/2023/04/14/average-solar-lcoe-increases-for-first-time-this-year/

Page 12, https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2022/May/IRENA_Innovation_Outlook_Ammonia_2022.pdf

The price of LNG in September 2023 was $42.60 /tonne. https://oilprice.com/Energy/Natural-Gas/Winter-Gas-Price-Rally-Unlikely-Despite-Recent-Volatility.html

LNG has an energy density of 53.6 GJ/tonne, or 15 MWh/tonne. So at current price levels of $42.60 /MWh, LNG is priced at $639 /tonne.